When trekking to Everest Base Camp, it is essential to have the appropriate travel insurance. High altitudes up to 6,000 meters, emergency helicopter rescue, medical care, trip cancellations, and lost equipment should all be covered by the best insurance. Trekkers can choose from providers such as True Traveller, SafetyWing, and World Nomads.

It's crucial to purchase the policy in advance of your vacation and review all the information, particularly the evacuation and altitude coverage. In Nepal, the majority of trekking businesses need confirmation of insurance. A well-thought-out plan will give you peace of mind and allow you to enjoy your Everest trip without worrying about unforeseen issues.

Best Travel Insurance for Trekking to Everest Base Camp

Many people dreaming of trekking to Everest Base Camp. Reaching the foot of the highest mountain in the world is an experience that will never be forgotten, and the views are breathtaking. The trek is an important task that has some serious risks. This is why it is so crucial to get quality best travel insurance for Everest base camp trek.

Ascending to high altitudes on the Everest Base Camp trek exposes you to low oxygen levels and rapidly fluctuating weather. Altitude sickness, ankle twists, and helicopter emergency rescues are all possible. Rain or fog can create days-long delays for aircraft to or from Lukla. Additionally, you can lose your luggage or have your trip canceled.

If something goes wrong, you're protected if you have the proper insurance. It can cover emergency helicopter rescue costs, medical expenses, and assistance in the event that your plans unexpectedly alter. Without it, you might have to deal with high costs and a lot of stress.

In this blog, we’ll show you what kind of insurance you need, which companies offer the best plans, and how to choose the right one. You may concentrate on enjoying the trek knowing that you're covered in case something unforeseen occurs if you have the right coverage.

Although trekking to Everest Base Camp is a breathtaking and thrilling experience, there are risks involved. Things can go wrong, including high altitude sickness, missed flights, and injuries. Having the appropriate travel insurance is crucial because of this. Let's examine what your insurance needs to include in order to keep you safe when trekking to EBC.

What Should Trekking Insurance Cover?

Helicopter Rescue and Emergency Evacuation

Your insurance should cover Helicopter Rescue and Emergency Evacuation above anything else. There are no roads in the mountains, so the only way to obtain aid fast if you are sick or hurt is by helicopter. In Nepal, a helicopter rescue might cost more than $5,000 for a single mission.

Your insurance policy has to include:

- Helicopter rescue up to at least 6,000 meters

- Emergency evacuation from remote areas

Make sure your coverage expressly states that trekking at 5,364 meters is covered because that is the elevation of Everest Base Camp. The 4,000-meter limit on some insurance plans is insufficient for this walk.

AMS, or high-altitude sickness, can be harmful. Additionally, you could sprain your ankle, develop a terrible cold, or contract food poisoning. Although the quality of medical care in Nepal's cities is outstanding, it can be costly, particularly at private hospitals in Kathmandu.

Medical Expenses and Hospital Care

The following should be covered by your insurance:

- Hospital treatment in Nepal

- Doctor visits and medicine

- Transportation to the hospital from the airport

Verify that the medical coverage under your policy is at least $100,000. In Nepal, that is typically sufficient for emergencies.

Trip Cancellation or Interruption

Your trek may need to be canceled before it ever starts. Perhaps there is a delay in your flight. You can become ill prior to the trip. Or perhaps you have to return home early due to a family emergency.

You can receive reimbursement from travel insurance for:

- Flight cancellations

- Missed reservations for hotels

- Guide fees and trekking permits have already been paid.

This is particularly helpful if you have a package tour reservation. Just make sure the coverage covers the cancellation reasons (such as weather or illness).

Lukla Flight Delays or Cancellations

The short flight between Kathmandu and Lukla is famous for both its vistas of the mountains and its tendency for weather delays. Flights can occasionally be delayed by a day or longer.

Certain types of travel insurance include:

- Additional lodging in Lukla or Kathmandu

- New reservations for flights

- Weather-related lost trekking days

It is worthwhile to verify whether your policy offers a benefit for trip interruption or delay.

Lost, Stolen, or Damaged Baggage

Your luggage can get damaged during a jeep ride or lost at the airport. It occurs. Additionally, lacking equipment might make a long trip a complete fail.

Select insurance that provides coverage for:

- Trekking equipment, sleeping bags, and backpacks that have been lost or stolen

- Broken phones or cameras

- Payment for the replacement or renting of equipment

Examine the amounts that the insurance will cover for each item. For pricey boots or jackets, some plans only pay up to $300 per item, which might not be sufficient.

COVID-19 and Illness Coverage

Having a coverage that covers COVID-19 treatment or trip cancellation in the event of a positive test is a good idea these days. These days, a lot of insurance providers include this in their basic coverage. Ask your provider if you're concerned about becoming ill before or during your trip:

- Does the policy cover medical care connected to COVID-19?

- If I test positive prior to my flight, would I receive my money back?

Adventure Sports and Trekking Add-Ons

Trekking and adventure sports are not always covered by certain travel insurance policies. To be completely covered, you might need to select an add-on.

Look for choices such as:

- Trekking to high elevations

- Package for "Adventure sports

In the absence of this, even if you have injuries while on the route, your claim may be rejected. Read the fine print before purchasing any travel insurance. Make sure it covers everything mentioned above, with a focus on high-altitude trekking and evacuation.

Ask the insurance provider or consult ourtrekking agency, Nepal Trekking Routes for assistance in selecting the best coverage if you are not sure. You can relax and concentrate on what really matters. You can focus on enjoying the journey of a lifetime when you have reliable coverage.

Best Travel Insurance Providers for Everest Trek

Just as essential as a pair of trekking boots or warm jacket is getting the appropriate insurance while organizing your Hiking to Everest Base Camp. Unexpected issues may arise because of the high altitude, isolated paths, and weather variations. Therefore, it is wise to pick a travel insurance provider who is knowledgeable abouttrekking in Nepal and can support you in the event that things don't work out.

Here are a few of the most well-known and trustworthy travel insurance companies for trekkers going to Everest Base Camp, along with information on what they cover, what to look for before purchasing, and why they could be a good fit for your journey.

World Nomads Travel Insurance

It is suitable for adventurers, backpackers, and people under 70.One well-known brand in the adventure travel industry is World Nomads. High-altitude trekking up to 6,000 meters is covered by their travel insurance, making it ideal for EBC Trek (5,364 m). They also arrange for lost luggage, trip delays, and emergency helicopter evacuation.

Advantages:

- Covers trekking at high altitudes (using their Explorer Plan).

- In the event of altitude sickness or injuries, helicopter rescue is included.

- includes coverage for both ordinary travel concerns and medical emergencies.

- You can purchase or upgrade coverage while you're on the road.

Things to look for:

Be sure you select the appropriate plan (not the Standard Plan, but the Explorer Plan). Always confirm the altitude restriction for the country in which you now reside.

SafetyWing Travel Insurance

SafetyWing is a more recent company that is gaining traction due to its various insurance options and reasonable monthly costs. Hiking and trekking are covered, and you can acquire coverage for trips up to 6,000 meters if you upgrade to Nomad Insurance. It works well for Longer-distance travelers, remote workers, and digital nomads.

Advantages:

- Plan in the form of a monthly subscription easy to start and end

- includes hiking to the elevation of Everest Base Camp.

- includes an emergency evacuation.

- When traveling with a parent, children under ten are admitted free of charge.

Things to look for:

- To obtain coverage for high-altitude trekking, you must upgrade.

- does not always cover trip cancelation or equipment loss Read the fine print.

True Traveller Travel Insurance

Adventure sports and high-altitude trekking can be added as optional extras to True Traveller's well-known flexible programs. It's excellent for those who are engaged in more than just trekking in Nepal. It is suitable for European and British tourists seeking personalized adventure coverage.

Advantages:

- Trekking up to 6,000 meters is covered with the appropriate upgrade.

- Covered are emergency medical and evacuation services.

- Missed flights, luggage loss, and trip delays may be included.

- Choice to create your policy specifically using what you require

Things to look for:

- Only citizens of the UK and Europe can access it.

- Remember to include hiking coverage when making your order!

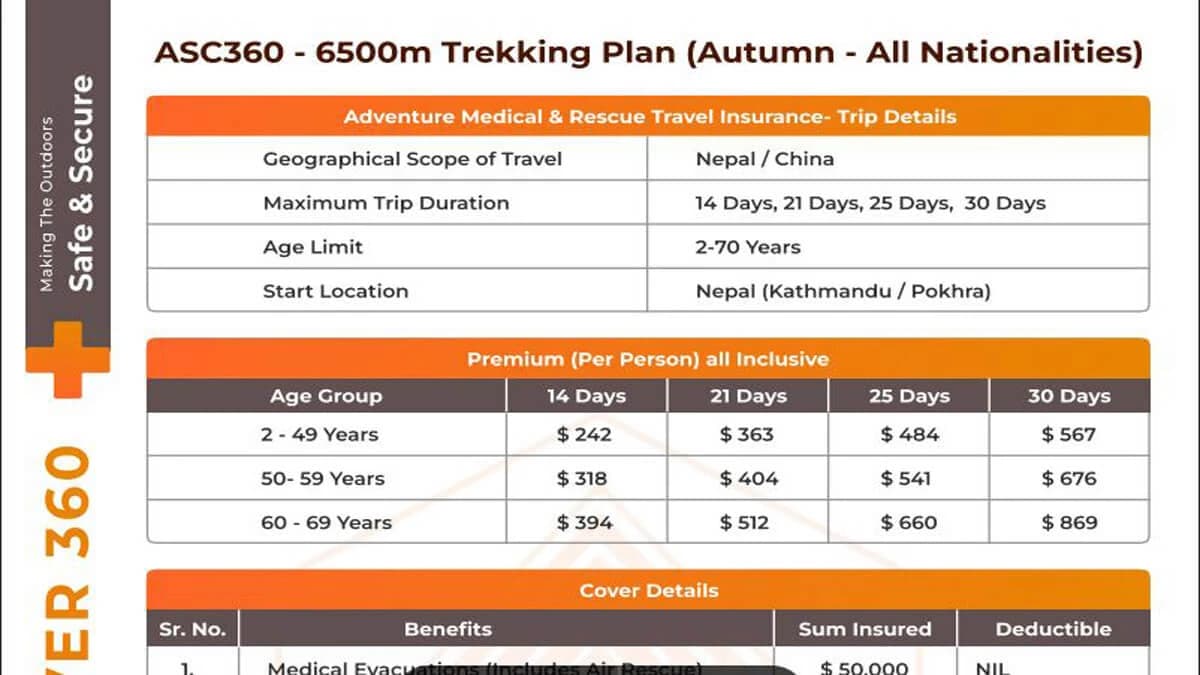

ASC360 Travel Insurance

High-altitude trekking and adventure activities can be added as optional coverage under ASC360’s specialized adventure insurance plans. It is ideal for travelers and tour operators involved in trekking and mountaineering activities across Nepal’s major Himalayan routes. This coverage is especially suitable for international trekkers for reliable, locally supported adventure insurance.

Advantages:

- Trekking coverage up to 6,000 meters with options to extend up to 8,848 meters.

- Cashless emergency medical treatment and helicopter evacuation in Nepal

- Strong on-ground rescue coordination and local operational support

- Designed for popular treks such as Everest Base Camp, Annapurna Circuit, Manaslu Circuit, and Gokyo Ri

- Helps tour operators reduce operational risk and build client confidence

Things to look for:

- Coverage level must match the maximum altitude of your trek

- Ensure adventure and trekking activities are clearly included in the selected plan

- Higher-altitude expeditions require upgraded coverage

We recommend you buy ASC360 insurance, as it is one of the best travel insurance options in Nepal, due to its local expertise, flexible coverage and strong emergency support. While buying the insurance, you have to put the operator name as "Nepal Trekking Route" on it.

Global Rescue Travel Insurance

Climbers and trekkers frequently use the upscale service Global Rescue in extremely isolated locations. They are a membership-based emergency rescue and evacuation service rather than a conventional insurance provider. They will plan and finance mountain evacuations, but you still need health insurance. It is beneficial for high-altitude trekkers, expedition climbers, and people with health issues.

Advantages:

- Excellent for EBC, Island Peak, Mera Peak, etc.; no altitude restriction.

- They plan hospital transfers, medical transports, and helicopter rescues.

- round-the-clock assistance from knowledgeable field teams

- IMG Global is a partner that allows you to add travel insurance.

Things to look for:

- costly in comparison to other suppliers

- You will still need separate medical insurance unless you add IMG plan

- Works best when combined with a traditional travel insurance plan

How to Pick Your Travel Insurance Plan for Everest Base Camp Trek

For your Everest Base Camp (EBC) trek, selecting the appropriate travel insurance is vital. It can be confusing to have so many alternatives. Don't worry, it gets much simpler if you know what to look for. Here are some tips for choosing the best travel insurance for your trip to EBC.

Consider Your Country of Origin

First, find out if the insurance provider covers citizens of your nation. Certain insurance companies only accept customers from the USA, Canada, Australia, or Europe. Others may have global plans. Before you spend time comparing plans, always be sure to verify this first. For instance:

- For Europeans, True Traveller is fantastic.

- SafetyWing covers many countries, including Asia, South America, and Africa.

- World Nomads is popular for travelers from most places, but not all.

Understand Your Style of Trekking

Are you walking alone or in a group? Are you hiking alone or as part of a guided trek? These decisions are important since the risks associated with various hiking styles vary.

- Guided Treks: Although you will have a guide to assist in an emergency, you still need complete insurance.

- Independent Treks: You will need to exercise extra caution and ensure that your insurance covers rescue and evacuation without the assistance of a local contact.

While some insurance providers provide better assistance for lone travelers, others are more effective for guided groups.

Verify the Highest Altitude Reached

The elevation of the Everest Base Camp is 5,364 meters (17,598 feet). You may only be covered up to 3,000 or 4,000 meters by certain insurance plans. For this trek, that won't work. Make sure that activities up to 6,000 meters are explicitly covered by your insurance plan. You might not be protected on your peak trekking days if this is absent, particularly at Kala Patthar (5,545 meters). Look for the phrases "trekking up to 6,000m" or "high-altitude trekking" in the policy.

Ensure Hospital Rescue is Featured

The quickest way to go to a hospital in the event of a leg break or altitude sickness is via helicopter. The price range for these helicopter rescues is $3,000 to $5,000 USD. Some insurance plans may not cover this unless you upgrade to adventure sports or pay more. Examine the policy thoroughly. Something along the lines of "Emergency evacuation, including helicopter rescue in Nepal" should appear. Before beginning the journey, trekking organizations in Nepal, such as Nepal Trekking Routes, request documentation of helicopter rescue coverage.

Look at the Duration and Activities Covered

Will you only be walking the entire time, or do you also have plans to go river rafting or paragliding? Pick an insurance that includes coverage for everything you intend to do, not simply trekking. Additionally, confirm that the insurance covers the duration of your journey, including the days you spend traveling before and after the walk.

While some plans offer predetermined packages, others allow you to choose the dates and activities of your trip. For adventurous travel, the more adaptable ones are typically preferable.

Check for Pre-Existing Conditions

You must inform your insurance company of any health issues you may have, such as diabetes, high blood pressure, or asthma. If you fail to disclose these health conditions, you may not be covered by some policies. Seek out a provider who will either cover pre-existing conditions or let you add them to your plan for an additional cost.

Read Reviews and Compare Prices

Spend a few minutes reading user reviews on sites such as Reddit or Trustpilot. Discover how actual hikers felt about their insurance in the event of a crisis. Cost is a factor, but in an emergency, clear communication and high-quality support are even more crucial.

Mistakes to Avoid When Buying Insurance for Everest Base Camp Trek

Are you preparing for your ideal journey to Everest Base Camp? One of the most crucial items you'll need is travel insurance, yet many trekkers make mistakes while buying it. These minor mistakes can lead to major issues, particularly in emergency situations. This is a list of the most typical errors and how to avoid them.

Failure to Verify Maximum Altitude Covered

Ignoring the insurance policy's altitude limit is one of the most common blunders people make. The elevation of the Everest Base Camp walk is 5,364 meters, and some side trips, such as Kala Patthar, reach 5,645 meters.

The only expedient means of getting to a hospital in the Everest region in the event of illness or injury is by helicopter evacuation. Many hikers are evacuated out each year because of severe issues like broken bones or altitude sickness.

Assuming Helicopter Evacuation is Covered by All Policies

The hitch is that helicopter rescue is not always covered by travel insurance policies. Others won't pay unless your life is in jeopardy. Others might not even mention helicopters.

Before purchasing insurance, make sure it states:

- Covered up to 6,000 meters

- Emergency helicopter evacuation included

- Trekking in Nepal permitted

Ask the business directly or search for another supplier if you are unable to locate this.

Buying insurance after starting the trek

Waiting too long to purchase insurance is another typical error. After arriving in Nepal or even after they begin trekking, some tourists believe they may purchase it. However, a lot of insurance providers won't pay anything if you buy the policy after your trip has started.

Always purchase insurance before departing your nation of residence to ensure your safety. In this manner, you will be covered from the start of your trip, including any delays or misplaced luggage while traveling to Nepal.

Ignoring the Fine Print and Exclusions

Every travel insurance policy has a "fine print," or a list of exclusions, or items it does not cover. This is a crucial section that many people neglect to read. Read the exclusions carefully or get in touch with the business directly.

- Is trekking to Everest Base Camp covered by this plan?

- Is rescue by helicopter included?

- Do pre-existing conditions qualify for coverage?

Choose a business that specializes in adventure trekking if you're unsure.

Choosing the Cheapest Policy without Sufficient Coverage

Although everyone wants to save money, don't allow a plan's low cost be your only consideration. Less coverage is frequently provided by cheaper insurance, which might be risky if you have a major problem while driving.

Keep in mind that you are traveling across the Nepal Himalayas. A solid insurance plan serves as your fallback in case of emergencies and is more than simply paperwork. Seek a balance between affordable prices and attractive advantages, such as:

- 24/7 emergency assistance

- Rescue and medical coverage

- coverage for lost luggage and delayed flights

Customer service in Nepal

For any trekker going to Everest Base Camp, purchasing the appropriate travel insurance is a wise move. Avoid these typical errors. Take your time, carefully study the policy, and confirm that you are covered for trip alterations, medical rescue, and high altitude. You may enjoy the route with confidence when you have the proper insurance, knowing that assistance is only a phone call away in case of an emergency.

Does Trekking Companies in Nepal Require Travel insurance?

It's not only a good idea to have travel insurance if you intend to Trekking in Himalaya; it's frequently necessary. Before the trip starts, a lot of Nepal trekking firms require confirmation of insurance. Let's explore it so you understand why it's crucial and what to prepare for.

Why is Trekking Insurance important?

A major adventure trekking to Everest Base Camp (EBC). The route reaches over 5,300 meters (17,500 ft) high into the Himalayas. There are actual hazards at that elevation, such as altitude sickness, rocky route slipping, and abrupt weather changes. Should something go wrong, assistance might be far away.

This is where insurance is useful. Medical expenses, helicopter assistance, and occasionally even trip cancellations are covered by good trekking insurance. Without it, receiving assistance could be extremely expensive or take a long time.

What you Should Expect from Trekking Agencies?

Before beginning the journey, the majority of trustworthy trekking company in Nepal will need a copy of your travel insurance. This is particularly true for Everest Base Camp guided adventures.

What many agencies expect is as follows:

- At least 5,500 meters of trekking must be covered by your insurance.

- Emergency helicopter evacuation should be part of it.

- It needs to be good throughout the whole time you're in Nepal.

- It should not just cover accidents but also medical care.

The purpose of these standards is to ensure the safety of both you and the team assisting you. The company could not allow you to start the walk if you don't have the proper insurance.

How the Trekking Company Benefits from Insurance

Having the right insurance also helps trekking companies. Your guide must act quickly in the event of an emergency during the hike in Himalaya. If your insurance is still in effect, the company can contact your insurance company, set up a rescue helicopter, and ensure that you receive the care you require right away.

This provides everyone with peace of mind and eases the company's workload. Additionally, it allows the guide to concentrate on your safety and well-being rather than money or paperwork.

Why Nepal Trekking Routes Recommends It

Safety is the top priority at Nepal Trekking Routes. Before embarking on any of their high-altitude excursions, they strongly advise all trekkers to buy appropriate travel insurance. Specifically for Everest Base Camp, they request:

- Evidence of insurance coverage for helicopter evacuation

- Information about your provider hotline and emergency contact

- An English-language copy of your insurance policy

Although their staff is prepared to manage crises, insurance enables them to act more quickly and efficiently. Additionally, it facilitates and lessens the tension of your trekking trip.

What if You Don’t Have Travel Insurance?

Some businesses may assist you in purchasing insurance prior to the start of the journey if you arrive in Nepal without it. But this is dangerous. After leaving your native country, purchasing insurance may be more expensive and may not provide all the coverage you require.

Because of this, it's usually advisable to get insurance in advance from a reputable company that offers coverage for high-altitude trekking in Nepal.

Tips for buying Travel Insurance

Before you trek to Everest Base Camp, have the following last, useful advice in mind:

- Purchase insurance prior to the start of your journey. Many insurance companies won't cover you once you've left your own country.

- Verify altitude restrictions because Everest Base Camp Hiking is at 5,364 meters, make sure your coverage covers trekking up to at least 6,000 meters.

- Make sure to incorporate helicopter rescue; this is crucial in the event of high-altitude sickness or injury. In Nepal, helicopter rescues can be costly.

- Maintain copies of your insurance documents. Keep a digital copy on your phone and print a copy. Tell your trekking guide about it as well.

- Be aware of your emergency contact. Keep the emergency number for your insurance company handy at all times. It is necessary for prompt assistance.

- Inform your guide that you are covered. This can help if you need to make decisions quickly in an emergency.

- Understand what is not covered. Carefully read the fine print to prevent unpleasant surprises later.

You may rest easy knowing you have the proper insurance. Knowing that you are covered in case something unforeseen occurs during your walk allows you to appreciate the adventure more.

Does the Everest Base Camp trek require travel insurance?

Yes, without a doubt. Risks such as altitude sickness, injuries, or flight delays are common when trekking to Everest Base Camp, which is at a high altitude (over 5,000 meters). In an emergency, having adequate insurance protects you, particularly if you require medical treatment or a helicopter evacuation.

What should be covered by the EBC trek insurance policy?

Your policy ought to cover:

- Trekking at high elevations (up to at least 6,000 meters)

- Medical costs and hospital stays;

- Emergency helicopter evacuations;

- Trip cancellations or delays, particularly on Lukla flights;

- Misplaced or broken equipment and baggage

Which insurance providers are suitable for trekking in EBC?

Popular choices include of:

- World Nomads – Covers high-altitude treks

- SafetyWing – Good for long trips and flexible plans

- True Traveller – Great for UK/European trekkers

- Global Rescue – Premium rescue and emergency services

Can I purchase insurance after I'm in Nepal?

The majority of firms ask you to purchase insurance before to the start of your journey. It's safer to purchase in ahead, while some foreign suppliers might provide last-minute plans.

Does all travel insurance actually cover helicopter rescue?

No, not all the time. Pay close attention to the policy because some policies do not allow helicopter evacuation unless you pay more. Verify this before making a purchase.

Does the Everest Base Camp climb require a visa?

Yes, a Nepal tourist visa is required for all foreign visitors (apart from Indian nationals) in order to enter the nation. You can apply online ahead of time or pick it up when you arrive at the Kathmandu airport. Verify that you have at least six months left on your passport.

Are visa problems covered by my travel insurance?

Delays or rejections of visas are not covered by the majority of ordinary travel insurance policies. However, if your visa is rejected prior to departure, some premium insurance might provide limited coverage for trip cancellation. Always carefully review the policy specifics.

Will my insurance protect me for the entire time I'm in Nepal on a visa?

Yes. Having travel insurance that covers your entire visa stay in Nepal, or just a little bit beyond, is ideal. This guarantees that, even in the event that your expedition is postponed or prolonged, you will be protected for the duration of your stay in the nation.

Does obtaining a Nepal visa require presenting proof of travel insurance?

No, in order to get a tourist visa, Nepal does not require travel insurance. However, before you begin your trek, trekking firms could request it, particularly for Everest Base Camp.

If I wish to stay longer after the walk, is it possible for me to extend my visa?

Yes, you are able to extend your tourist visa at the Kathmandu Department of Immigration. If your travel insurance is due to expire, don't forget to extend it as well if you decide to remain longer.

Conclusion: Travel Insurance for Everest Base Camp Trek

Although trekking to Everest Base Camp is a once-in-a-lifetime experience, there are genuine risks involved, including extreme altitude, unpredictable weather, and isolated trails. Because of this, getting the proper travel insurance is not only a good idea, but also necessary. Medical crises, helicopter evacuation, travel delays, and even misplaced equipment are all covered by a decent insurance package. These things can happen, and being ready allows you to concentrate on the journey's beauty rather than your worries.

Examine the fine print, compare policies, and pick one that covers walking up to 6,000 meters or more before you depart. For EBC trekkers, reliable suppliers like World Nomads, SafetyWing, or True Traveller provide good choices. Additionally, confirm that your strategy satisfies the safety requirements of your local trekking organization, such as Nepal Trekking Routes. You can trek with assurance and peace of mind if you have the proper coverage.